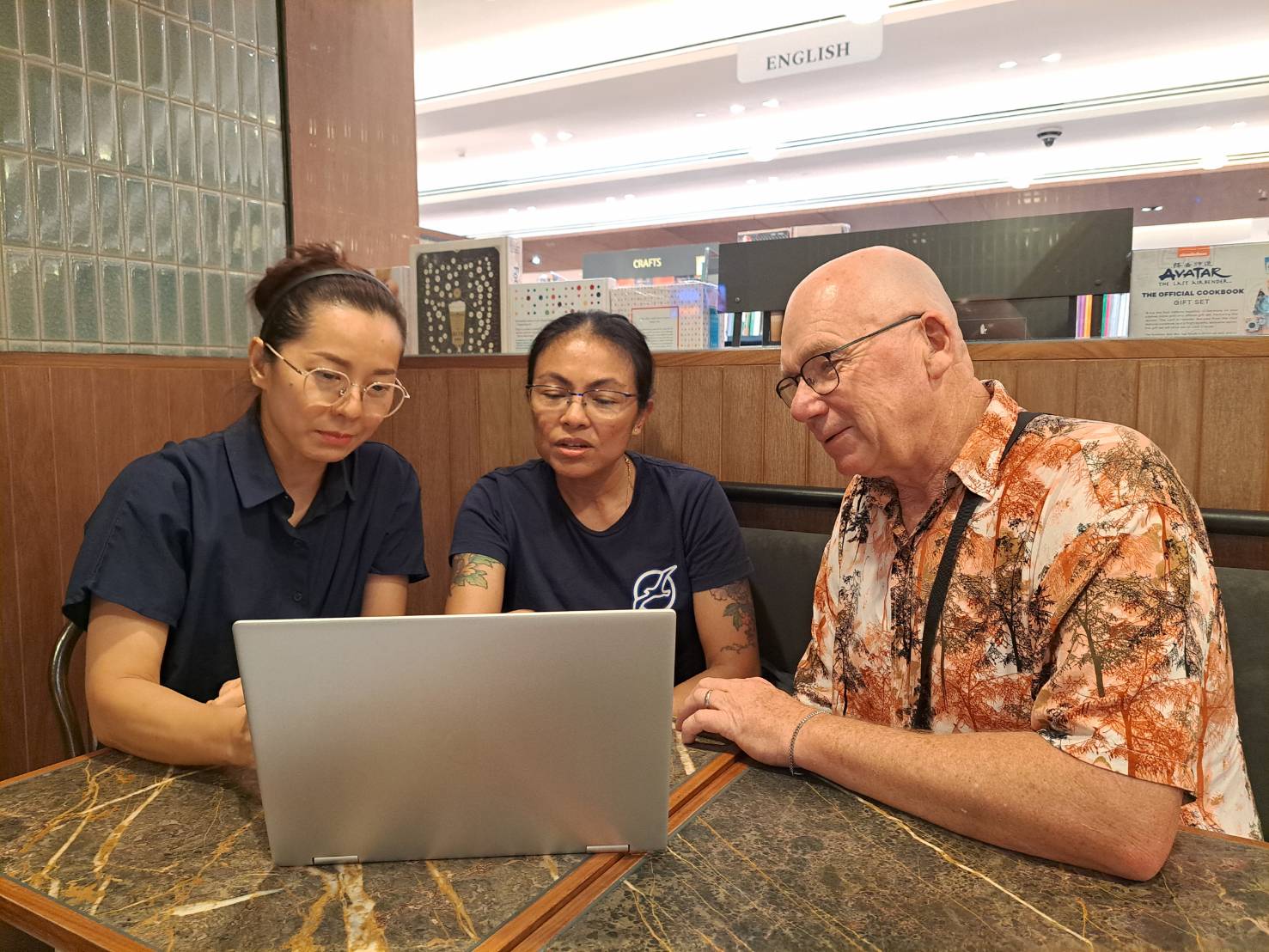

20+ years of international work experience

- Leveraging over 20 years of experience collaborating with multinational colleagues and serving diverse international clients, I provide expert consultation to foreign nationals residing in Thailand who seek life or health insurance for themselves or their families.

- My services include advising on the selection of appropriate health insurance plans required for the application of Non-Immigrant Visa ‘O-A’ (Long Stay) or Non-Immigrant Visa ‘O-X’ (Long Stay). This guidance specifically addresses the minimum health coverage requirements, which stipulate 400,000 THB for inpatient (IPD) medical treatment and 40,000 THB for outpatient (OPD) medical treatment.

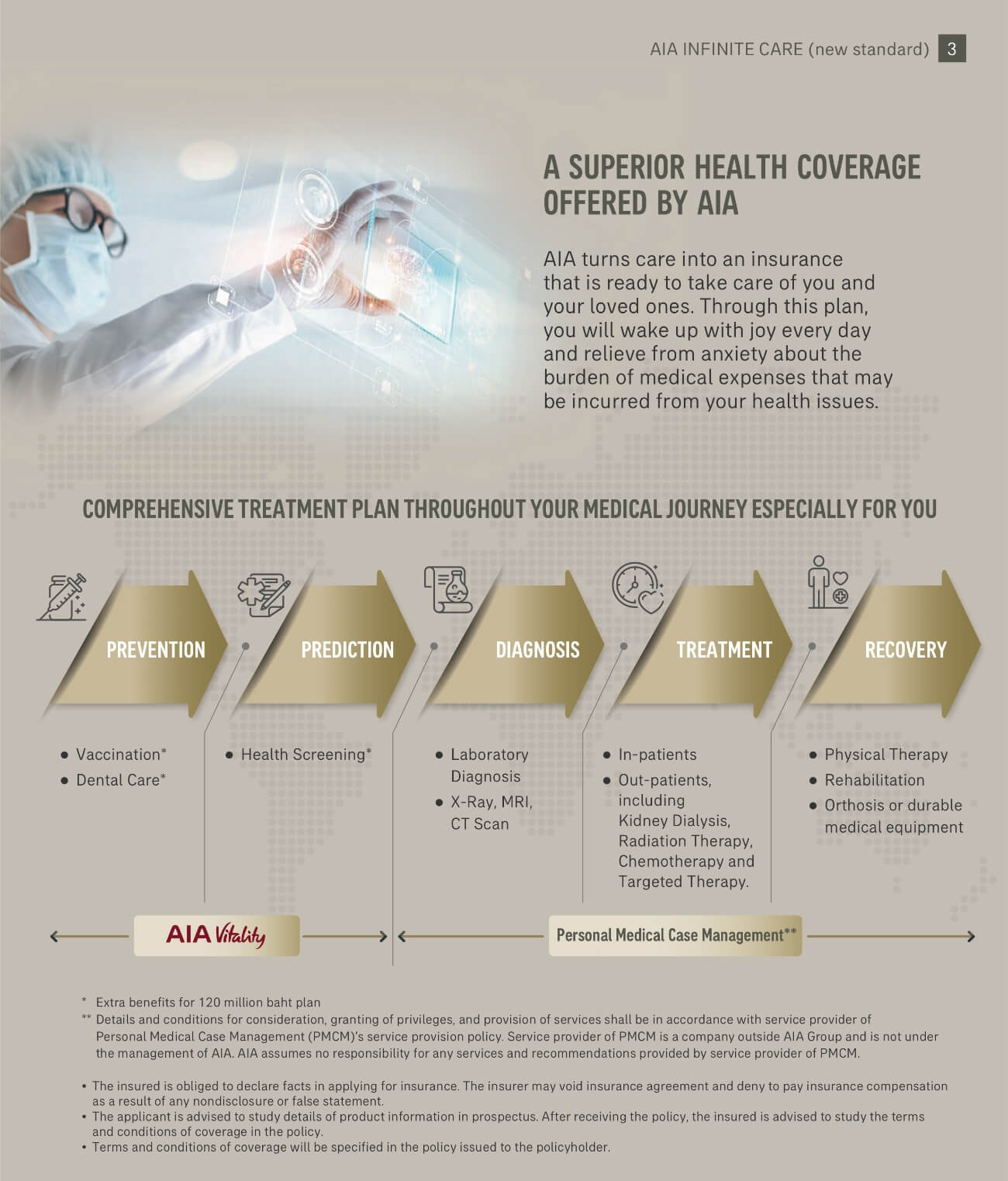

AIA Infinite Care: International Health Insurance for Foreigners

This health insurance is designed for foreigners, offering AIA’s best plan with worldwide coverage and international medical service access.

- Eligible for individuals aged 18 – 75, renewable up to age 98, with coverage up to age 99.

- Covers both health and accident-related treatments with no need to purchase separate riders – comprehensive coverage in a single policy.

- Includes general health check-ups, vaccinations, and genetic screening.*

- Covers both inpatient (IPD) and outpatient (OPD) treatment benefits, including dialysis, radiation therapy, chemotherapy, targeted therapy, and emergency treatment.

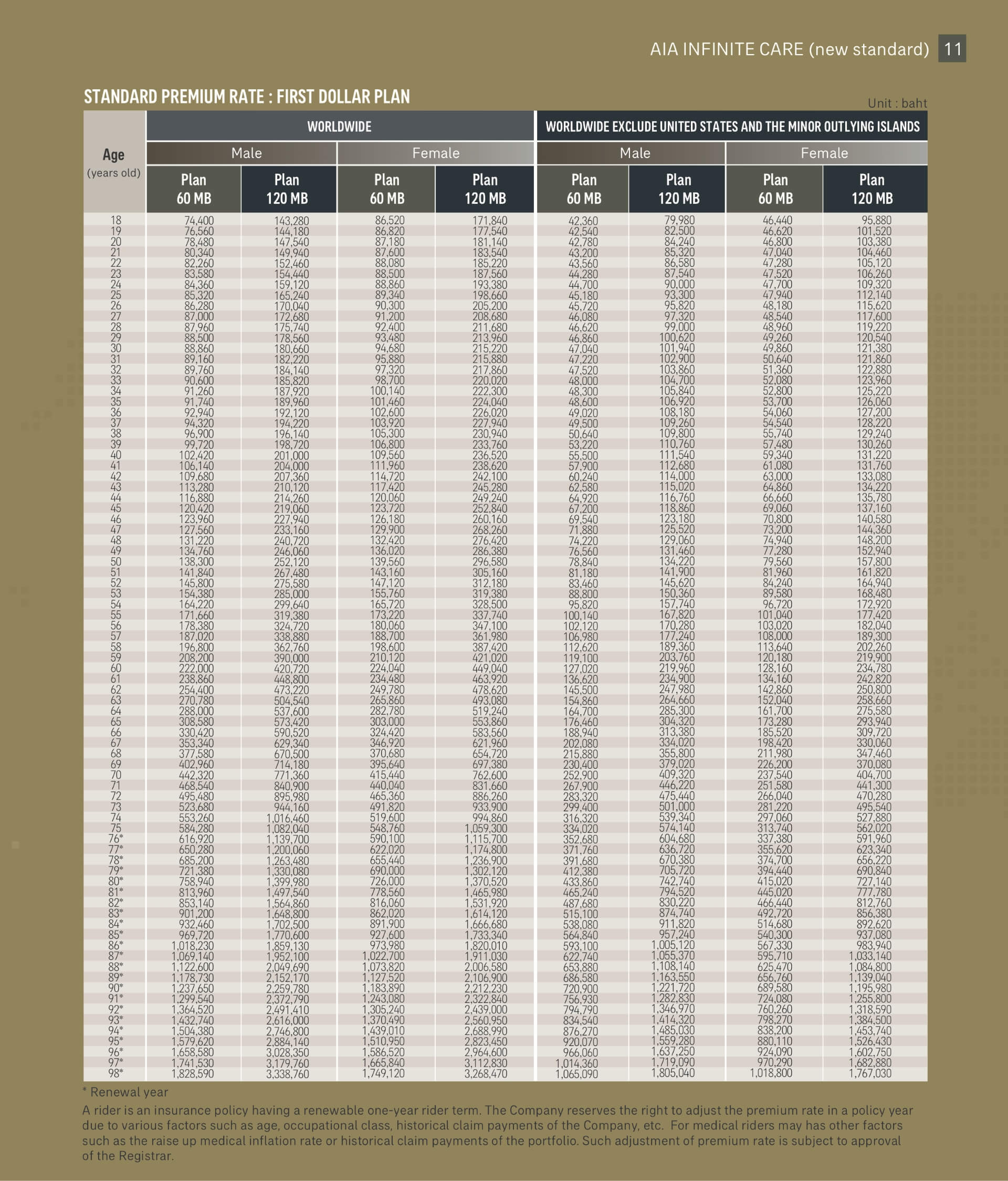

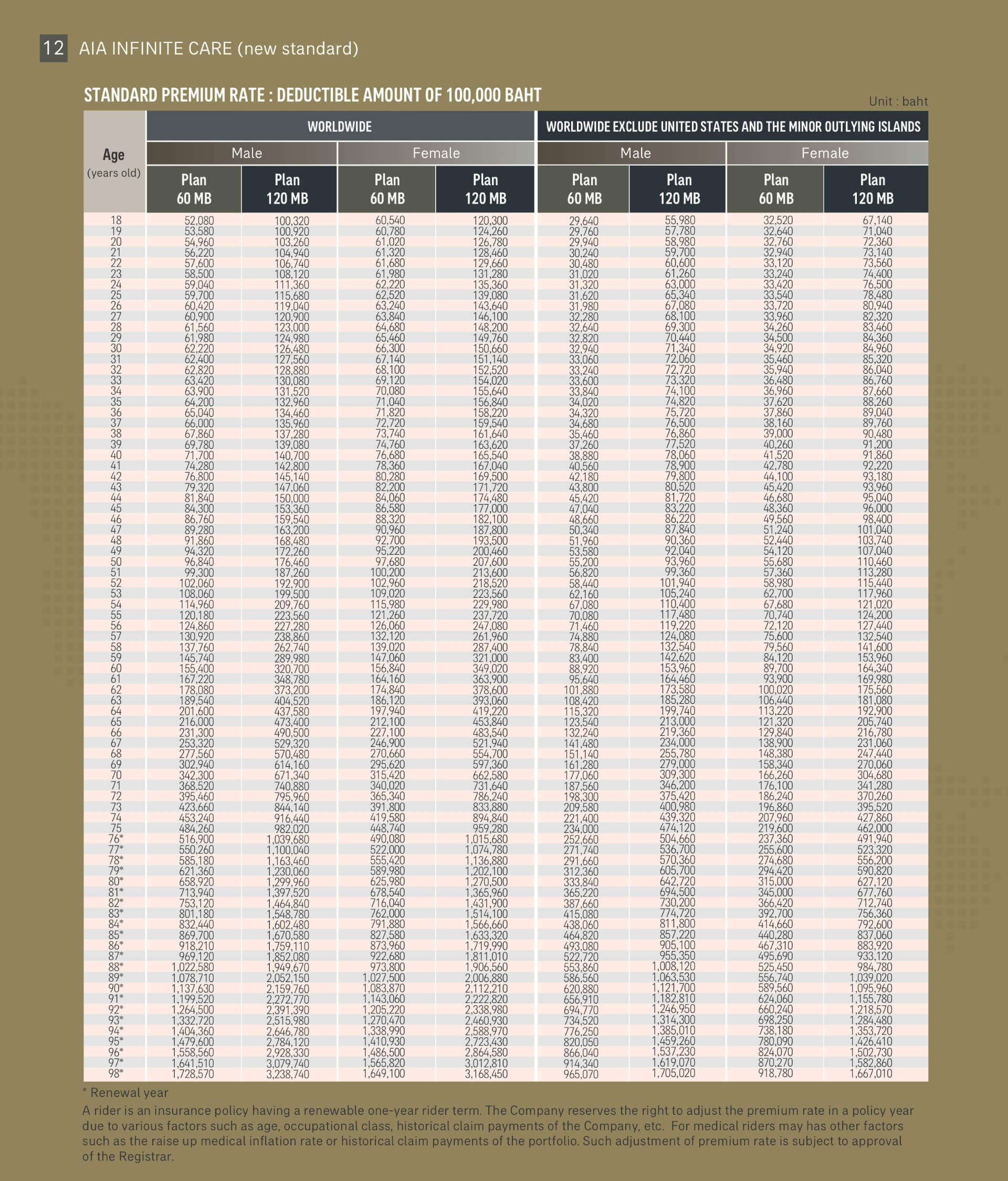

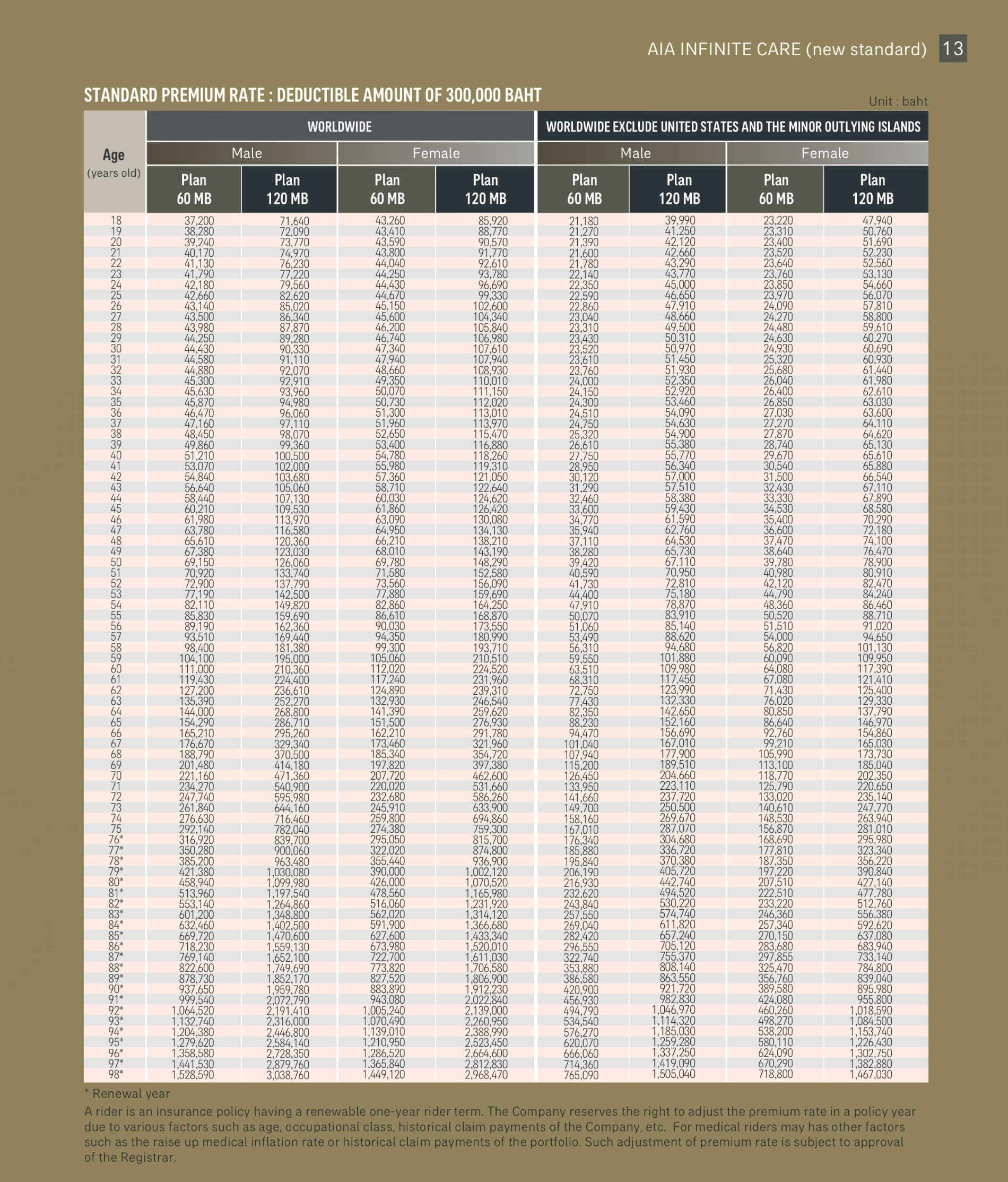

- Coverage amounts start at 60 million THB and go up to 120 million THB per policy year.

- Option to choose no deductible or a deductible of 100,000 THB / 300,000 THB.

- Option to select coverage area: worldwide or excluding the United States and its territories.

Who Is This Health Insurance Plan Suitable For?

- Foreigners and expatriates who work or reside in Thailand.

- Foreign business owners and investors residing in Thailand.

- Foreign retirees and long-term residents in Thailand (with regular financial transactions or pension income).

- Frequent international travelers who require global protection.

- Individuals seeking innovative treatments and international medical services.

- Those requiring premium services such as Personal Medical Case Management (available in the 120-million-baht plan).

Brief Benefits Table

| BENEFITS | PLAN 60 MB | PLAN 120 MB |

|---|---|---|

| Maximum benefits per policy year | 60 MB | 120 MB |

| Room & Board | 12,000 baht/Day | 25,000 baht/Day |

| ICU Room | As charged | As charged |

| Medical examination & treatment | As charged | As charged |

| Medicine for take-home | As charged | As charged |

| Doctor’s daily visit (Professional fee) | As charged | As charged |

| Operating room, medical supplies, surgical instruments | As charged | As charged |

| Physician’s fee for surgery & procedure | As charged | As charged |

| Physician’s fee (Anesthesiology) | As charged | As charged |

| Organ transplant surgery | As charged | As charged |

| Day Surgery | As charged | As charged |

| Pre & Post hospitalization diagnostic (within 30 days) | As charged | As charged |

| Outpatient follow-up after hospitalization (within 30 days) | As charged | As charged |

| Accident treatment | As charged | As charged |

| Rehabilitation treatment | As charged | As charged |

| Dialysis, chemotherapy, radiation therapy | As charged | As charged |

| Emergency ambulance service | As charged | As charged |

| Minor Surgery | As charged | As charged |

| OPD general per policy year | Max 40,000 Not cover/year (incl. rehab, up to 15 visits) | Max 100,000 Not cover/year (incl. rehab, up to 15 visits) |

| Orthosis or durable medical equipment during being injured or sick | As charged | As charged |

| Fees for OPD treatment related to before admission within 30 days | As charged | As charged |

| Fees for follow up OPD treatment of injury within 30 days per accident | As charged | As charged |

| Dental care due to accident | As charged | As charged |

| Physical therapy and occupational therapy | Included in OPD | Included in OPD |

| Annual health check-up | Not cover | 10,000 baht |

| Vaccinations | Not cover | 6,000 baht |

| Dental care | Not cover | 15,000 baht |

| Death benefit | 10,000 baht | 10,000 baht |

| Tax Deduction Eligibility | Eligible | Eligible |

| BENEFITS | PLAN 60 MB | PLAN 120 MB |

|---|---|---|

| Maximum benefits per policy year | 60 MB | 120 MB |

| Room & Board | 12,000 baht/Day | 25,000 baht/Day |

| ICU Room | As charged | As charged |

| Medical examination & treatment | As charged | As charged |

| Medicine for take-home | As charged | As charged |

| Doctor’s daily visit (Professional fee) | As charged | As charged |

| Operating room, medical supplies, surgical instruments | As charged | As charged |

| Physician’s fee for surgery & procedure | As charged | As charged |

| Physician’s fee (Anesthesiology) | As charged | As charged |

| Organ transplant surgery | As charged | As charged |

| Day Surgery | As charged | As charged |

| Pre & Post hospitalization diagnostic (within 30 days) | As charged | As charged |

| Outpatient follow-up after hospitalization (within 30 days) | As charged | As charged |

| Accident treatment | As charged | As charged |

| Rehabilitation treatment | As charged | As charged |

| Dialysis, chemotherapy, radiation therapy | As charged | As charged |

| Emergency ambulance service | As charged | As charged |

| Minor Surgery | As charged | As charged |

| OPD general per policy year | Max 40,000 Not cover/year (incl. rehab, up to 15 visits) | Max 100,000 Not cover/year (incl. rehab, up to 15 visits) |

| Orthosis or durable medical equipment during being injured or sick | As charged | As charged |

| Fees for OPD treatment related to before admission within 30 days | As charged | As charged |

| Fees for follow up OPD treatment of injury within 30 days per accident | As charged | As charged |

| Dental care due to accident | As charged | As charged |

| Physical therapy and occupational therapy | Included in OPD | Included in OPD |

| Annual health check-up | Not cover | 10,000 baht |

| Vaccinations | Not cover | 6,000 baht |

| Dental care | Not cover | 15,000 baht |

| Death benefit | 10,000 baht | 10,000 baht |

| Tax Deduction Eligibility | Eligible | Eligible |

CONDITIONS

Waiting period for AIA Infinite Care (new standard) rider

1.1 Any illnesses occurring within 30 days from the effective date of this rider or the date on which the Company approves the additional benefits of this rider, whichever date is later or

1.2 Any of the following illnesses occurring within 120 days from the effective date of this rider or the date on which the Company approves the additional benefits of this rider, whichever date is later such as

- Tumors, cysts or all types of cancer

- Hemorrhoid

- Varicose vein

- Hernia

- Pterygium or Cataract

- Endometriosis

- Tonsillectomy or adenoidectomy

- All types of stones.

Waiting period which only apply for extra coverage of 120 MB plan

1.4 Vaccination and Dental care occurring within 180 days from the effective date of this rider or the date on which the Company approves the additional benefits of this rider, whichever date is later.

Partial Exclusions of AIA Infinite Care (new standard) rider

- Conditions that are caused by congenital abnormalities, or congenital organ system defects, or genetic disorders, or growth development abnormalities.

- Esthetic enhancement treatment or cosmetic surgery or any other treatments for skin beauty purposes.

- Pregnancy, miscarriage, abortion, child delivery, obstetric complications, addressing problems with infertility (including investigations and treatments), sterilization, and contraception.

Additional Conditions for Worldwide coverage except the United States and the Minor Outlying islands

The medical treatments that are taken place in the United States and the Minor Outlying islands, the Company will provide coverage specifically according to the conditions stipulated in the benefits table as follows:

- Physical injuries from accidents.

- Emergency illnesses in the United States and the Minor Outlying islands in accordance with the definitions specified in this rider.

Regarding 2 emergency cases mentioned above, the first hospitalized date in the United States and the Minor Outlying islands must fall within the first 90 days of entering the United States and the Minor Outlying islands for each trip. The Company will provide coverage for the necessary and appropriate expenses incurred from the medical treatments in accordance with the medical necessity and standards in the United States and the Minor Outlying islands.

Download Brochure

Application Process for AIA Infinite Care Health Insurance

Upon thoroughly reviewing the information regarding AIA Infinite Care health insurance and selecting a plan that aligns with your needs, the subsequent steps are as follows:

- Meet with an AIA Agent: Schedule a meeting with an AIA agent to complete the application form via the AIA application system. Please note that the system displays information solely in Thai; however, the agent will provide explanations in English for your understanding. It is crucial to accurately and truthfully declare your complete health history.

- Complete First-Year Premium Payment: The first year’s premium can be paid via credit card or QR Code, with direct transfer to AIA Co., Ltd.’s corporate account. For subsequent years, you may select alternative payment methods available in the payment system, such as automatic bank account deduction or automatic credit card payment.

- Await Underwriting Results (Standard Cases): If you have no prior history of hospitalizations and your health meets standard criteria, approval is typically granted within 2 business days.

- Await Underwriting Results (Cases with Health History): Should you have a pre-existing health history, you will receive a memo from the company indicating any additional documents required. This may include, but is not limited to, past medical records, recent health check-up results, etc.

- Underwriting Decision Post-Submission of Additional Documents: After submitting the requested additional documents, the underwriting decision will be processed, resulting in one of three potential outcomes:

5.1. Unconditional Approval: The policy is approved without any modifications to coverage or premiums.

5.2. Conditional Approval: If your health history impacts long-term health risks, the policy may be approved with specific exclusions for pre-existing conditions.

5.3. Approval with Premium Adjustment: The policy is approved with comprehensive coverage for all conditions, but an adjustment to the annual health insurance premium is requested. - Client’s Decision and Documentation: Clients are required to review and accept the proposed terms by signing the relevant documents through the AIA system. Should you decline the conditions presented in scenarios 5.2 or 5.3, you have the option to cancel the contract and receive a 100% refund of the premium paid, or to submit additional documentation for a re-evaluation by the company.

Required documents for health insurance application

1. Clear first page of PASSPORT and valid VISA extension page up to the present.

2. Work Permit (first page and extension page up to the present).

3. For foreigners who conduct business in Thailand, please submit documents related to business registration in Thailand, financial statements/balance sheets, bank account statements, income tax payment evidence.

4. Record the confirmation of the place of solicitation for life insurance application, specifying the details correctly and completely. (Form will be provided by AIA Agent)

Agent Profile

Munisara Angsutam

OIC License : 6701030394

IC License : 133598

Chulalongkorn University, Master of Business Administration (MBA)

Services provided:

- Life & Health Insurance for Thai & Expats

- Critical Illness & Accident Coverage

- Retirement & Education Planning

- Investment-linked Insurance (Unit Linked)

- Visa-Compliant Health Insurance (Non-OA / OX)

- Policy & Claim Support in English